The stock market saw a surge on Wednesday following the Trump administration’s grant to automakers; a one-month exemption from tariffs, ABC News said.

Press secretary Karoline Leavitt said President Donald Trump has ordered the delay of auto tariffs after a request from the Big 3 U.S. automakers Ford, General Motors and Stellantis, according to ABC News.

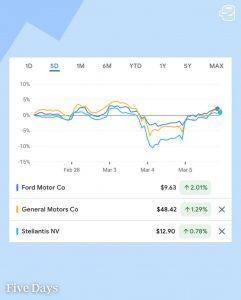

Automaker shares surged following the announcement, for example, Ford’s stock prices ended the trading day up almost 6%, General Motors climbed more than 7% and Stellantis rose over 6% on Wednesday, Investopedia said.

Image Source: Five Days

Leavitt said that Trump told automakers to “start investing, start moving, shift production here to the United States of America, where they will pay no tariff. That’s the ultimate goal.,” Automotive News said.

Stellantis said that they share President Donald Trump’s hopes of manufacturing more automobiles in the U.S., thanking him for a one-month exemption from tariffs on Canada and Mexico, according to Automotive News.

“We share the President’s objective to build more American cars and create lasting American Jobs. We look forward to working with him and his team,” Stellantis said.

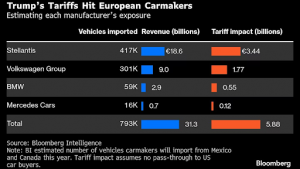

Stellantis and Volkswagen are the European automakers that are most exposed and at risk when it comes to U.S. President Donald Trump’s new tariffs on vehicles specifically imported from Canada and Mexico, Bloomberg Intelligence said.

The levies have potential to eliminate a total of $6.2 billion of the European automakers’ earnings this year, according to Bloomberg Intelligence.

Stellantis specifically led European automaker stocks down in trading on March 4. Its Milan-listed shares fell over 6 percent to the lowest in intraday trading since after CEO Carlos Tavares resigned on Dec. 2, Automotive News said.

Major suppliers that support auto companies in Canada and Mexico are also facing the pressure due to tariffs.

Image Source: Bloomberg Intelligence

Automakers and suppliers are expected to greatly pass up costs on the supply chain, which will result in higher prices for consumers.

The cost of many North American vehicles could go up by $4,000 to $10,000 due to tariffs on Canada and Mexico, according to an analysis by Anderson Economic Group.

These tariffs pose risks for the U.S. auto sector according to Bernstein Research analyst Daniel Roeska.

“Unless there is a swift policy reversal, we anticipate severe disruptions in North American supply chains and automotive profit margins,” Roeska said.